Award-winning PDF software

Printable Form SS-4 San Diego California: What You Should Know

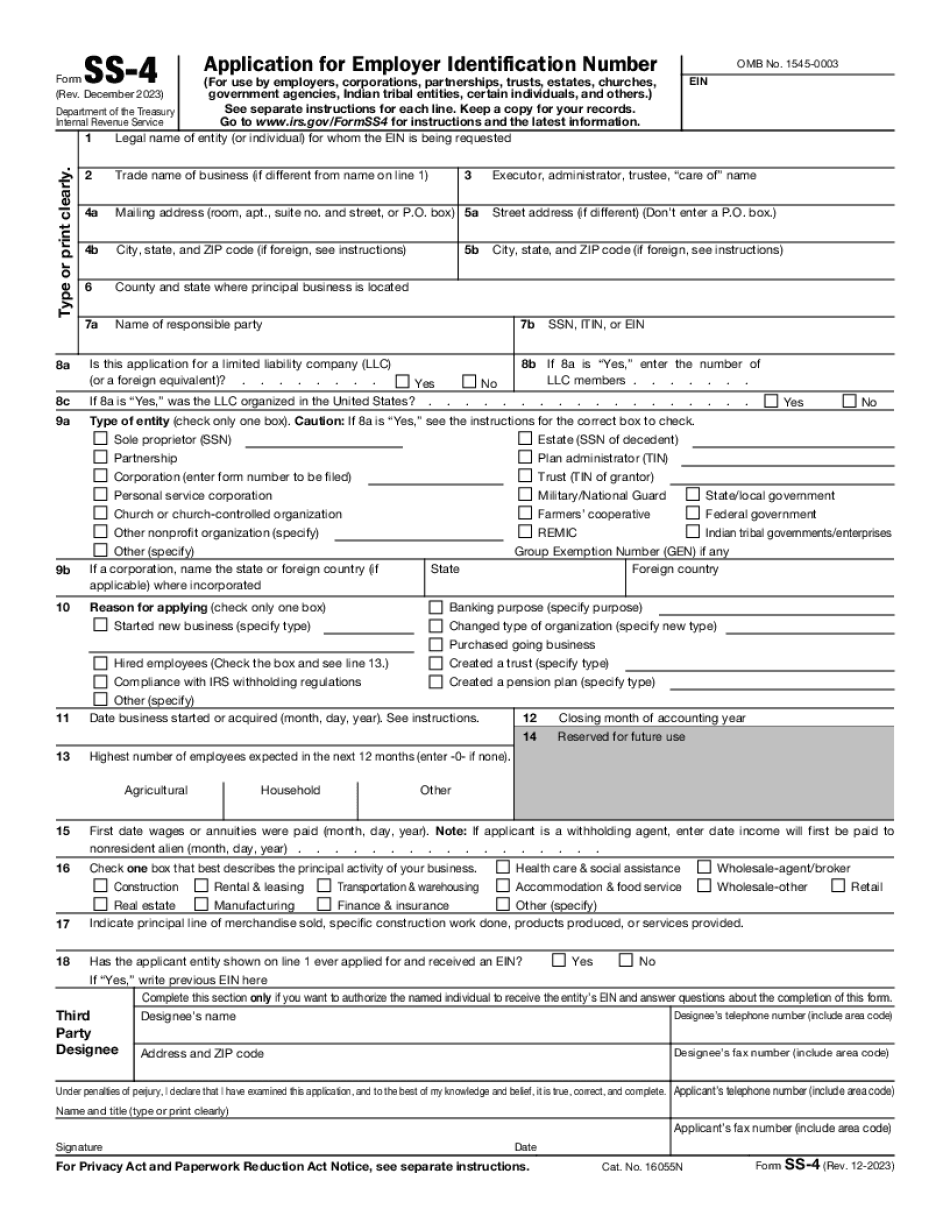

San Diego Business Improvement Association (SD BIA) Business License Fees for 2025 (Effective July 1, 2018) Business License Fee Schedule PDF Business License Fee Schedule PDF The State of California Department of Business Oversight (DBO) provides annual Business License Fee Schedule to businesses seeking to incorporate in San Diego County. This is required by local and state law to ensure that only businesses legally and structurally qualified to conduct business in the county are registered to do business and earn revenues and profits. The fee schedule provides the following amounts for business license fees. The fees listed on the schedule are effective for the fiscal year of the County as well as the fee schedules will change annually. It may be necessary and beneficial to review the schedule annually to ensure that all fees are being properly calculated and applied. DBO Business License Fees for Fiscal Year 2018 Type or print clearly. 1 Type of business as indicated on the business form/application, 2 Payment to the County of San Diego of fee due, 3 Deadlines for payment to County of San Diego (notices to creditors), 4 Fee is subject to change without notice, 5 No refund of a fee if payment is due 30 Days after the due date, 6 No refund of a fee if a cancellation of a noncredited license will not affect the fee of a new, credited license. 7 Total amounts due is based on the number of business licenses issued, 8 Failure to pay fee and late fee will result in a 10 late fee or an administrative fee of 5%. Incorporation/Change of Incorporation Forms Form SS-3 : The SS-3 is a 10-page non-commercial, single-page incorporation form. If a corporate “meeting of the minds” has been held, this is the most common form used. The SS-3 is used to incorporate an entity with limited liability and in-place shareholders. Form SS-4: The SS-4 is a 15-page corporation incorporation form that provides for the formation, existence, and dissolution of an incorporated entity. The 15-page SS-4 incorporates the LLC by way of a single-page statement that is electronically signed and returned to the IRS. However, this will not become effective if the LLC is not yet incorporated. Form SS-6: An SS-6 is a corporate tax return that is only effective when filed electronically. It must be filed by February 1st per Section 6011.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Printable Form SS-4 San Diego California, keep away from glitches and furnish it inside a timely method:

How to complete a Printable Form SS-4 San Diego California?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Printable Form SS-4 San Diego California aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Printable Form SS-4 San Diego California from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.