Award-winning PDF software

Form SS-4 Texas Dallas: What You Should Know

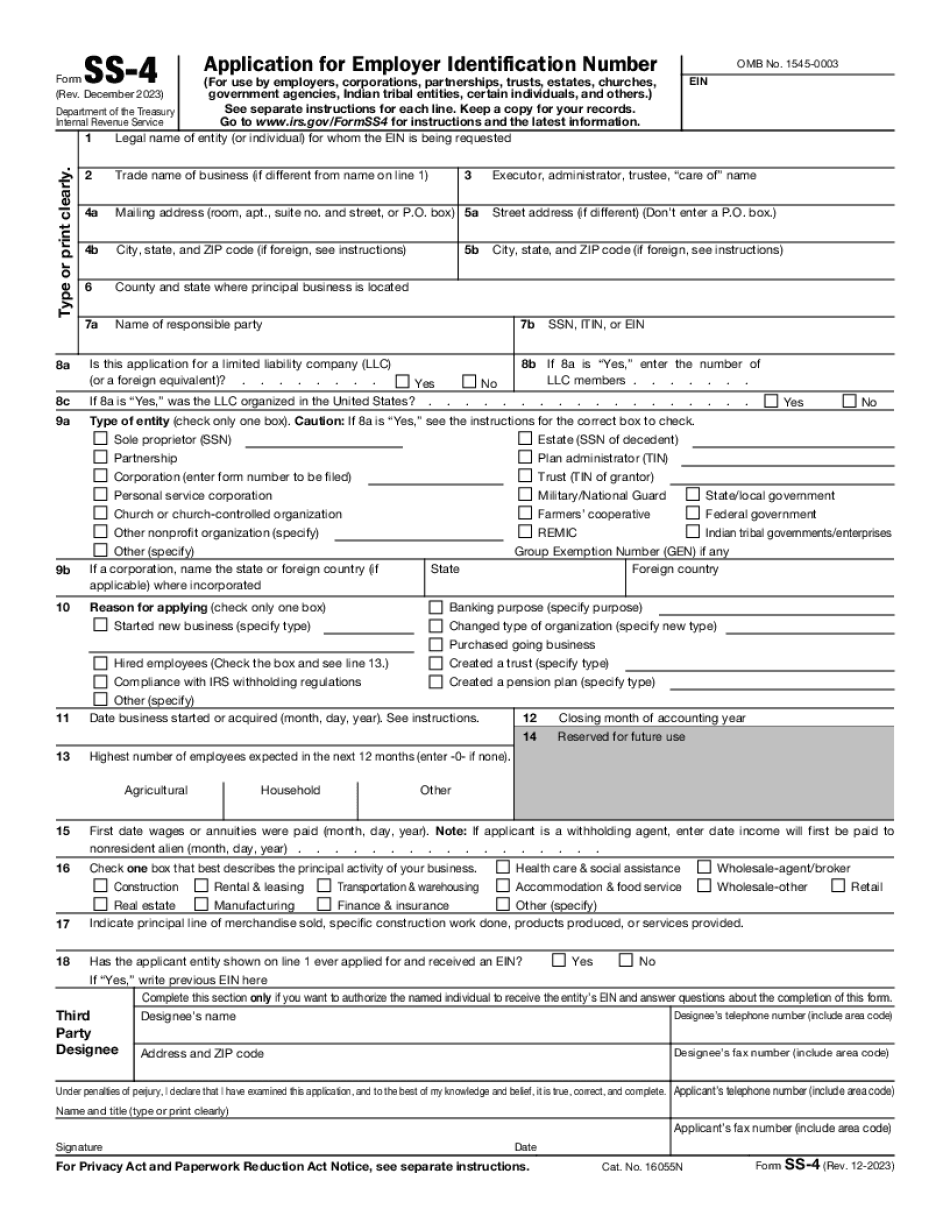

Online EIN filing (for Form SS-4) FAQs: Online EIN filing FAQs The EIN information you provide to us on the Form SS-4 Application for Employer Identification Number (Form SS-4) will be automatically posted to the Free EIN Program for your information. We will not send you any copies of the information to post to the Free EIN Program, so please do not submit additional information. Frequently Asked Questions What do I do if my name and/or address for the employer is incorrect? Please provide details to help us understand the type of error. The types of error are listed on the Instructions for File Form SS-4 (2022) and on the FormSS-4 Frequently Asked Questions (PDF). If the name or address on my Form SS-4 is incomplete, will I receive a notice and be notified as soon as possible? If your name and/or address on Form SS-4 is incomplete, we will notify you via email, but no further action will be taken if you do not respond within 60 minutes. Please check your email and make sure you submit a response. We will keep you informed through the process. If there are no instructions and I do not receive a notification, what should I do to complete the Form SS-4? Complete the Form SS-4 and attach additional evidence of ownership. Send completed form by U.S. mail, fax, or to an address approved by the Texas Department of Labor. Who is the Texas Department of Economic Development? The Texas Department of Economic Development (TIED) is a department of the state government. TIED administers state tax laws, licenses and certifies businesses to create jobs in Texas. The Texas Department of Revenue is the bureau of revenue in the Texas Department of Revenue. Texas Department of Economic Development, Texas Department of Revenue Texas Department of Finance TIED/DEQ THEE/DEQ What is an ERA? An Employer Reporting Number is one of a number of EIN numbers created by the U.S. Treasury Department. It is unique to each business and used by the IRS to confirm that the business registered with the IRS. An ERA is assigned by the IRS to individuals who have not registered for a Social Security Number. An ERA may also be assigned by companies that are self-employed or business entities, or companies whose ownership is primarily individual.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form SS-4 Texas Dallas, keep away from glitches and furnish it inside a timely method:

How to complete a Form SS-4 Texas Dallas?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form SS-4 Texas Dallas aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form SS-4 Texas Dallas from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.