Award-winning PDF software

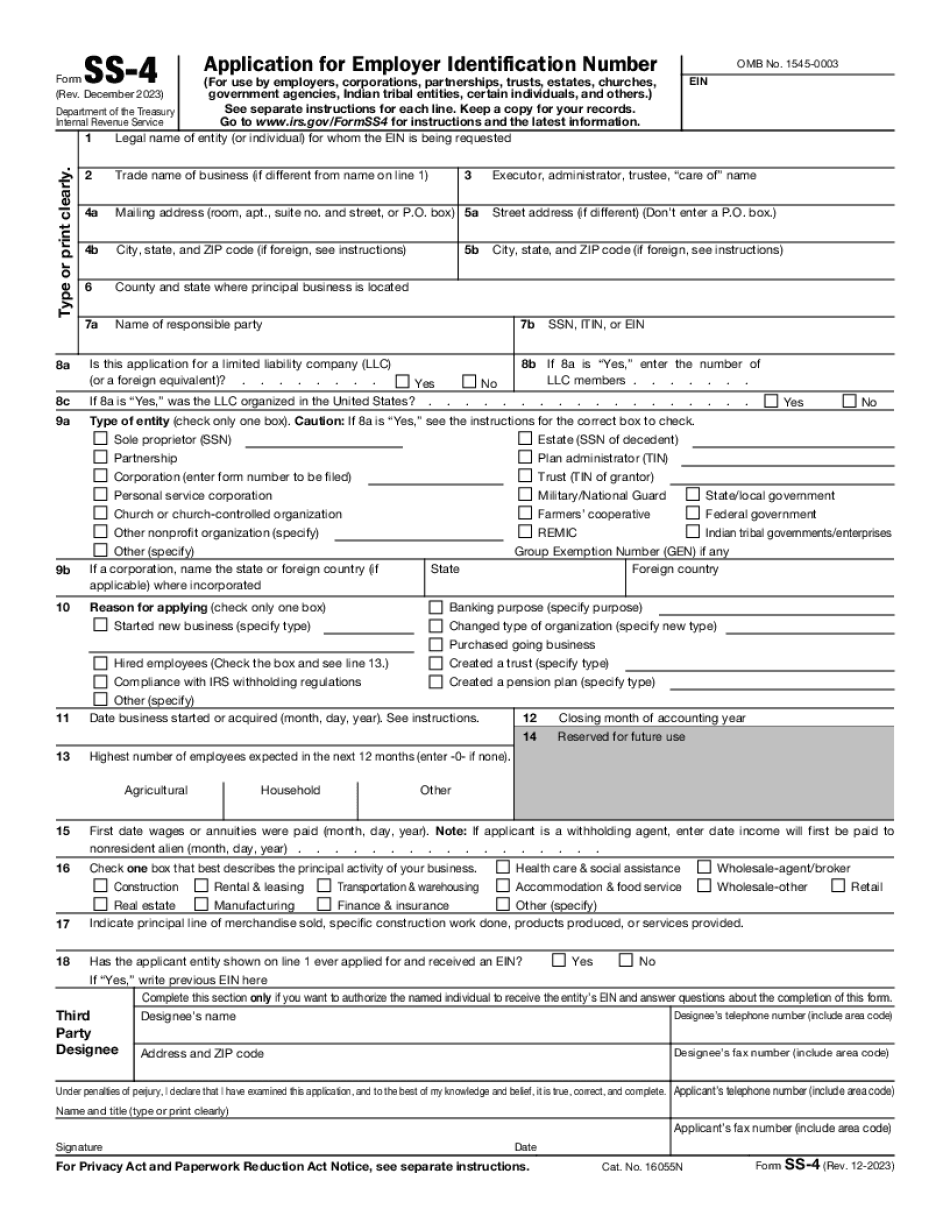

Form SS-4 for Palm Beach Florida: What You Should Know

Get the IRS Off Your Back. The IRS recently changed the way it handles taxpayer service calls. The IRS is now requiring all tax preparers to ask the taxpayer to provide a voice mail number as part of the call. As a result, the IRS will use the caller's voice mail to verify the caller's identity. This can be a huge problem for taxpayers because all the calls will be on voice mail—not regular landline phone numbers. “This is bad for consumers — when the IRS calls, it will be on voice mail — not a landline telephone, the call may be inaudible to anyone not listening on a cellphone or on speakerphone, thus it will likely be used to harass the taxpayer,” said Susan Miller of the Center for Individual Freedom, a free market think tank. “The IRS should not have to ask taxpayers to provide voice mail numbers, which has no place in IRS proceedings,” Miller said. How to Protect Yourself: Don't Call With Voice Mail 1. Get the IRS Off My Back 1. . . The IRS has developed a new way to track taxpayers' calls to IRS agents. They recently started using an IRS program called IRS Specially Designated Individuals (DDI) database. Since January, a new number has been assigned for each person who works at the tax return preparer with a voice mailbox. The number is based on the caller's IRS EIN. When you call the number, the IRS agent listens in on the call and records the call for review. [Source] 2. Get the IRS Off My Back 2. . . The IRS has developed a new way to track taxpayers' calls to IRS agents. They recently started using an IRS program called IRS Specially Designated Individuals (DDI) database. Since January, a new number has been assigned for each person who works at the tax return preparer with a voice mailbox. The number is based on the caller's IRS EIN. When you call the number, the IRS agent listens in on the call and records the call for review. You will receive calls either for tax advice or for an audit, and the call will probably not be recorded. Once you have made a long distance call to a tax professional, you should call back to verify if the call is recorded. Even if it is not recorded, you should assume that it is. 3.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form SS-4 for Palm Beach Florida, keep away from glitches and furnish it inside a timely method:

How to complete a Form SS-4 for Palm Beach Florida?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form SS-4 for Palm Beach Florida aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form SS-4 for Palm Beach Florida from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.