Award-winning PDF software

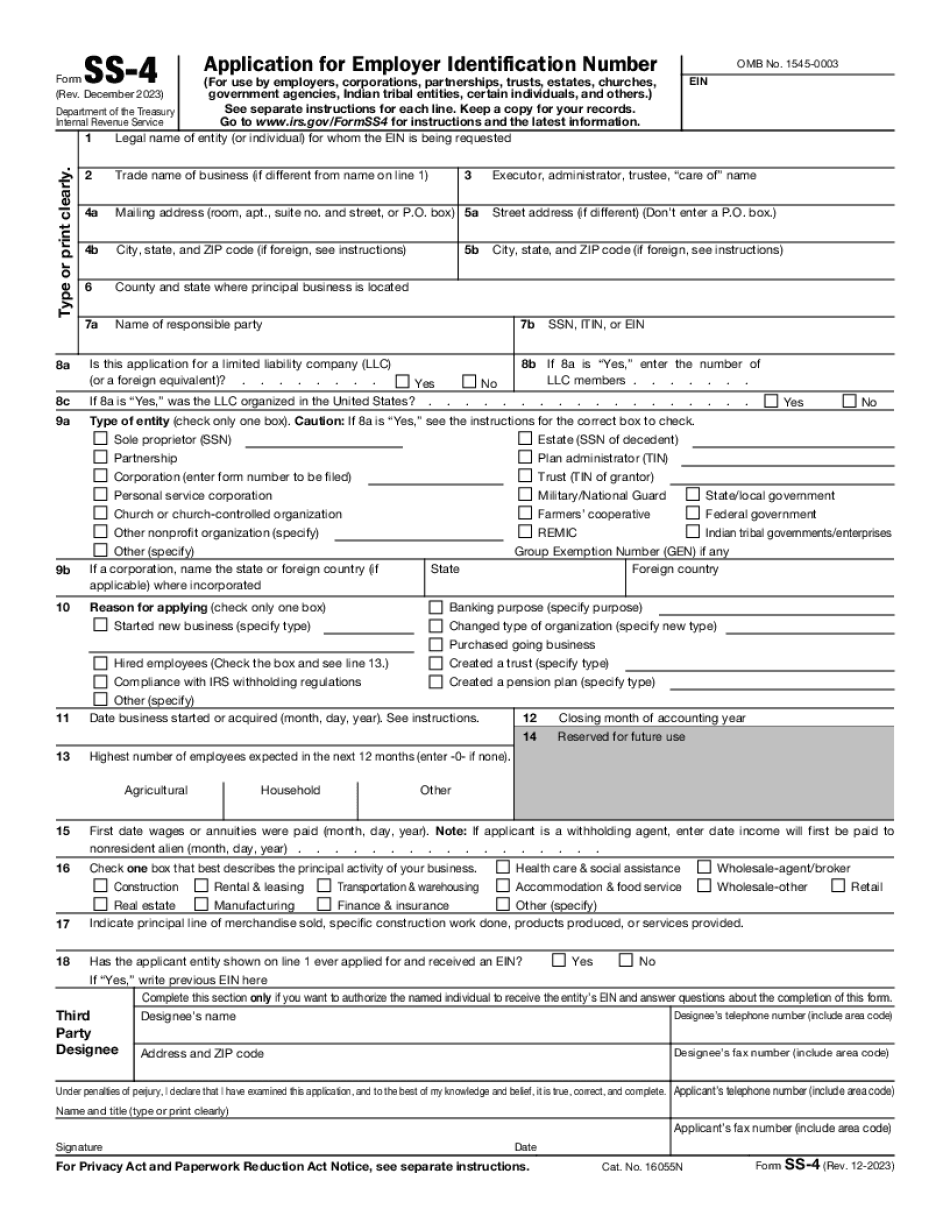

MT online Form SS-4: What You Should Know

Note: A spouse is considered unmarried if the applicant is not currently married. Form T-4 (TU1) if you: • Have received a disability payment from the government; or • Received disability or other benefits through any agency of Canada, the United States or any other country; or • Received a personal, non-commercial or other government benefit other than disability because of the applicant's own or a loved one's disability, including compensation for the cost of receiving a home or a retirement income or for the cost of nursing home care. Note: A spouse is considered unmarried if the applicant is not currently married. A surviving spouse has priority over other relatives in applying for benefits from government programs such as: • Social Security; • Old Age Security (OAS); • Canada Pension Plan; • Veterans Affairs; • The Canada Child Tax Benefit; • A guaranteed income supplement; • Guaranteed Income Supplement for Canada's Refugees; • Employment Insurance (EI) (refer to page 6 for details.) You must provide your spouse's name, age, tax file number, current address and a description of their relationship for the claim to be approved. If you are applying separately from your children, you are eligible to apply as a parent alone. Note: A spouse is considered unmarried if the applicant is not currently married, but a former spouse has entered into a registered life partnership and has received a T4A slip. This allows you to claim one-half of the benefits that this partner is entitled to, if you married after the partnership was dissolved. Please Note: No one who is eligible for survivor benefits can claim the Canadian Forces or a naval vessel service pension unless: a) one or both of you are alive, the children in question are under the age of 18 and either you or your spouse/ex-spouse have been residing in Canada since your spouse's death; or b) you had a spouse of the same sex, and you registered your life partnership as of May 1st, 2012. Do not use a different form for this benefit, as the form will not receive a signature from your deceased spouse. Important Note: In cases when there are two or more surviving spouses, only one person is entitled to the combined survivor benefit.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete MT online Form SS-4, keep away from glitches and furnish it inside a timely method:

How to complete a MT online Form SS-4?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your MT online Form SS-4 aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your MT online Form SS-4 from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.