Award-winning PDF software

Form SS-4 for Salt Lake Utah: What You Should Know

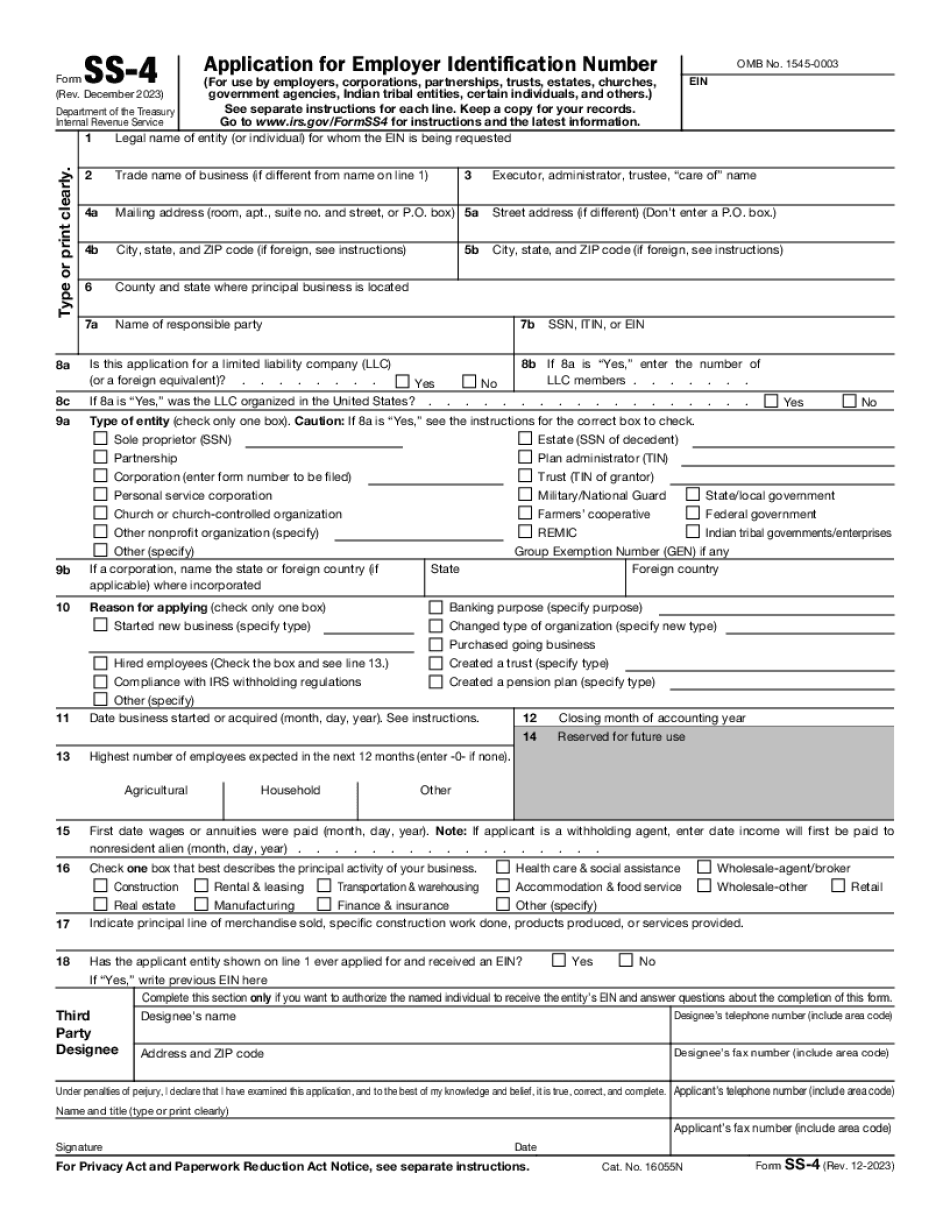

Phone:. Place: 1809 South 200 East, Draper. Phone:. The Internal Revenue Service has recently published two forms the Business License and/or the Business Registration for Private Practice (see IR-2015-43 and IR-2015-44) the process to obtain them is completely different for S corporation, sole proprietorship, and sole proprietorship forms with no way for you to file them online. 1. The Business License and/or the Business Registration for Private Practice (see IR-2015-43 and IR-2015-44) is required as of Jan 1st, 2020 Form SS-4 Required for Private Practice (Form SS-4, Application for Employer Identification Number) is available for purchase from the IRS. For help to learn more about the application go to IRS.gov/BusinessLicensure or call the office listed below for more information The Office of Private Practice (OPP) handles all state-specific questions relating to the private practice of law. They offer assistance with: State rules & regulations Private practitioners and their employees Business license requirements Legal notices and publications Other related questions. For more information, such as a list of online resources or online forms, please call: Phone:. OR E-mail: OPP state.UT.us 1. 2025 S.B. 538, S.B. 59, S.B. 55 and S.B. 613 have been implemented and will be effective on Aug 1, 2019. The Utah Secretary of State's Office has placed all SS-4 (Rev. December 2018) Forms with the new Utah Code in its online catalog. The Office can send out a copy of your SS-4 if you request one. Please let me or one of my staff know your Utah addresses by the end of September of any year. To receive one you must fill out and send back this one-page form and pay a 10 processing fee. Click on: Submit Form SS-4. 2. The IRS requires you to have an EIN number on your business tax return. EIN: Form 1040-ES and Form 5500-ES 3. The State of Utah requires you to obtain a Business license/trademark certification from the Secretary of State every year.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form SS-4 for Salt Lake Utah, keep away from glitches and furnish it inside a timely method:

How to complete a Form SS-4 for Salt Lake Utah?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form SS-4 for Salt Lake Utah aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form SS-4 for Salt Lake Utah from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.