Award-winning PDF software

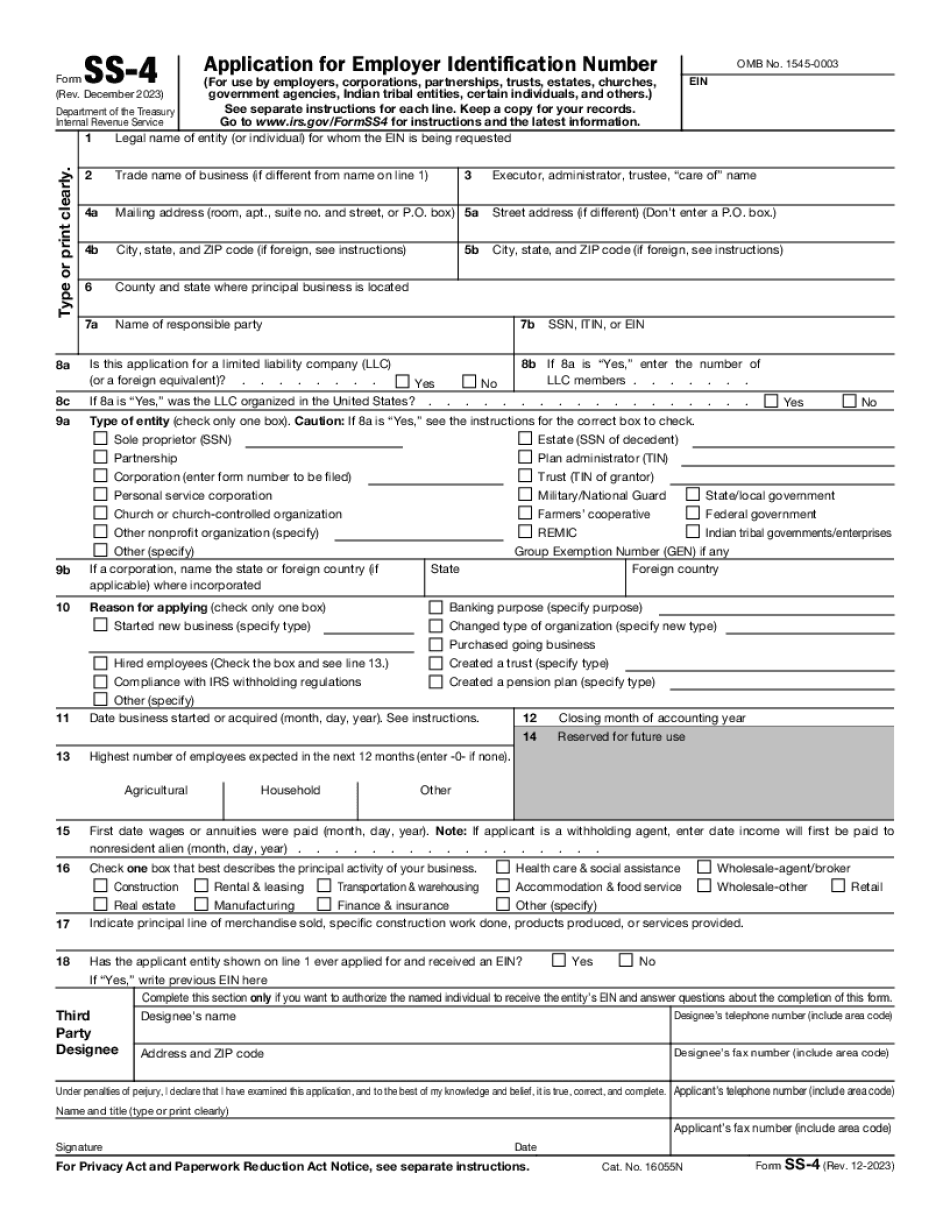

Las Vegas Nevada Form SS-4: What You Should Know

See our Nevada State Guide for important information such as: business entity rules (Revised 2018) Form SS-4 for Sales and Use Tax Permits — Nevada Department of Taxation For help forming a corporation or business entity see this web page. Get information about corporate tax in Nevada, including filing forms, paying tax and more. Nevada Corporation Center Form SS-4 for Sales and Use Tax Permits — Nevada Department of Taxation You need an EIN to open a corporation or business. See a list of all Nevada corporations and business entities. Form SA-8 and SA-9 are required to register your corporation or business if the corporation or business: Will be doing business in Nevada. Will have a minimum of 25 members. Must be incorporated by or under the laws of Nevada. To find out which forms are required under which laws, visit the Nevada Secretary of State website. Nevada Corporate Registry Filing Corporation or Business Income Tax (BUT) Returns For business entities that are registered, must file annually or more frequently in order to be valid. Step-by-Step Guide to a Statewide BUT Reporting — Nevada Tax Department Read the Nevada State BUT Guide and Publication 1212 before filing an annual report. To view other useful sections of Publication 1212 please see the publication. The form is also available by fax. Nevada, USA Form SS-4, Application for Employer Identification Number. Contact the Nevada Business Registration & Business Licensing Division for help at x101. More Business Registration & Business Licensing Topics | To register any property, enter into a lease, or change your address contact the local county registrar of deeds. Contact the county registrar or assessor on file with the county office of real property assessment to change or update a taxpayer's address before filing your assessment. To find out more about property registration contact: Phone: 866.644.6800 The County assessor's office may be able to assist you if you are registering your home or commercial property. Business License: 866.641.4400 To apply for a business license, you must obtain a Business License application. Form NM-80, Application to Register a Business in Nevada, or Form NM-8P, Application to Register a New Business in the State of Nevada. Business License Forms. You can also apply online.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Las Vegas Nevada Form SS-4, keep away from glitches and furnish it inside a timely method:

How to complete a Las Vegas Nevada Form SS-4?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Las Vegas Nevada Form SS-4 aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Las Vegas Nevada Form SS-4 from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.