Award-winning PDF software

Form SS-4 online Glendale Arizona: What You Should Know

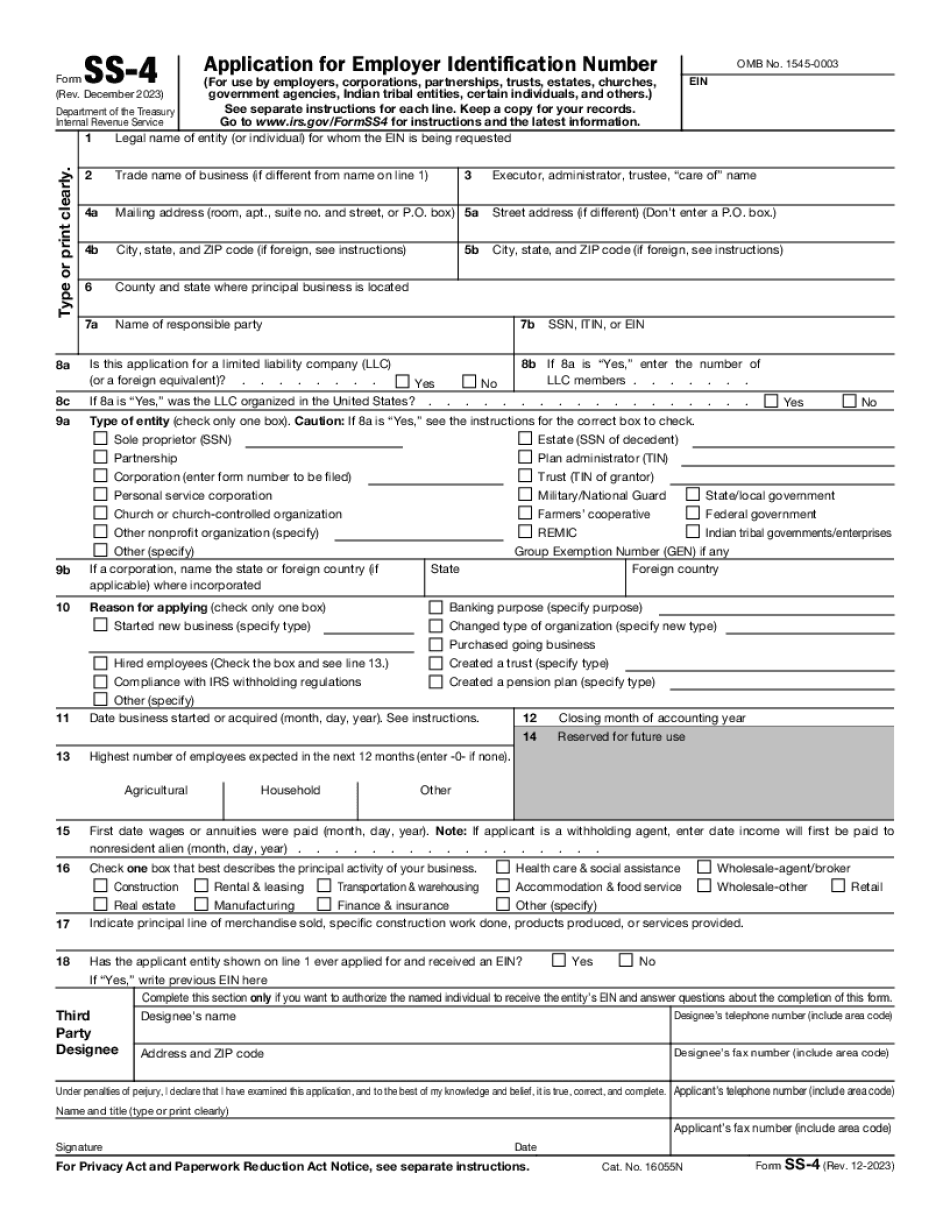

A copy of all requirements for use of the program may be used for research purposes with the requirement that the applicant provides the program administrator a signed release that discloses any commercial or noncommercial usage, and the source of the material. This means no copying is made of the information provided. In order to successfully apply the applicant must use their own e-filed tax return (with information on all expenses) and a certified copy of their current EIN is required. If any of the income information is inaccurate due to clerical errors or is not current, the applicant will be liable for an additional assessment based on the corrected income amount. Please include an electronic or physical proof of your EIN such as a driver's license. EIN / Tax ID number 866001000957. An impostor call or email, report it to SSA using their detailed online form. About Forms SS-4 (Rev. 12/2018) — IRS Form SS-4 is the form for individuals or entities who are seeking an Employer identification number (EIN) for employers as an extension of their Social Security number. An EIN is a form of identification used by businesses or other entities to file tax returns with the IRS and for other purposes generally allowed by law. There are a number of EIN requirements to be met. Employers who want to be issued an EIN must have a business location in the state in which the employee resides. In the case of an individual, a request for an EIN must be sent by the individual's mail to the Social Security office in the state in which the individual resides. Please click on the following link for more information. If you would like to obtain an Employee Identification Number (EIN), as an employer, you must contact the Wage and Employment Division by a letter addressed to the “Wage and Employment Division” at the above address. Form SS-4 (Rev. 12/2018) is available here. Also, a general EIN can be obtained on this site by entering the employer's Social Security number. For further information on how to start your business, please call the Wage and Employment Division at. (Updated September 15th 2018) A few weeks ago I started this page, but as I received so many requests/suggestions that it seems appropriate at this time to create all my pages in one place, with a single page for all new applications.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form SS-4 online Glendale Arizona, keep away from glitches and furnish it inside a timely method:

How to complete a Form SS-4 online Glendale Arizona?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form SS-4 online Glendale Arizona aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form SS-4 online Glendale Arizona from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.