Award-winning PDF software

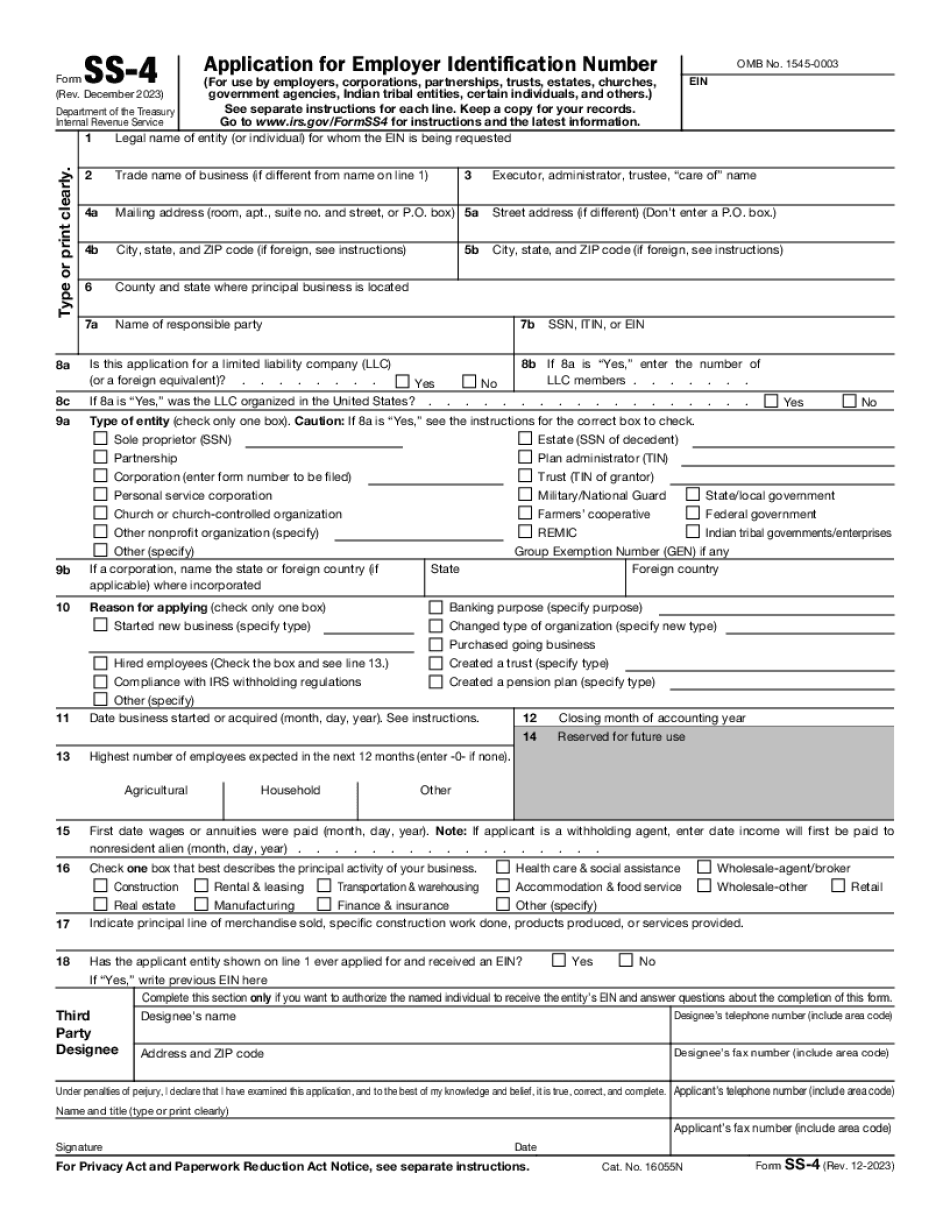

Form SS-4 Irving Texas: What You Should Know

How to apply For information on how to apply by mail: Go to For information on how to apply by phone: Click the Contact Us button near the top of the screen and call (toll-free in Texas), (toll-free in all other states). Apply by mail The application must be postmarked by September 15, 2019, or mailed to the Business Registration Division of the IRS at one of the following addresses: IRS Attn: SS-4 (Rev. December 2019) 800 Maryland Avenue, NW Washington, DC 20230 ____ The application must be received at least five days before tax filing and must be accompanied by the following: (1) A completed Application for Employer Identification Number and, if the applicant entity has no EIN, a letter from the IRS certifying that the applicant entity has filed all required Federal income tax returns for the last year of financial years, including the most recent Federal tax return for the applicant entity, (2) The SS-4 form and all amendments to the application for a SS-4 (if appropriate), (3) The applicable fee, and (4) Documentation of the applicant entity's tax compliance. The SS-4 form must be submitted with the following attachments to an IRS Express Mail delivery address: Incomplete or incorrect attachment The SS-4 is now in effect. Effective for tax years beginning with tax year 2019, the application is not an original tax return, but a tax registration statement. Form SS-4 has the same authority for filing as individual and trust returns. Irving, Texas 75061: Click the “Get Started” button and follow the instructions. For help with the application contact the Taxpayer Services Division. IRS Taxpayer Assistance Centers (Tags) may provide tax preparation and assistance, including filing fee payment assistance for the current year. There is an average wait time of about 4.5 weeks to schedule a TAC session in a TAC office. For more information please call the nearest TAC office at. Online Filing Instructions The information on this Web Page and the instructions you are given to complete your tax return will help you complete your return and will be your responsibility alone.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form SS-4 Irving Texas, keep away from glitches and furnish it inside a timely method:

How to complete a Form SS-4 Irving Texas?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form SS-4 Irving Texas aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form SS-4 Irving Texas from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.