Award-winning PDF software

Form SS-4 for Vacaville California: What You Should Know

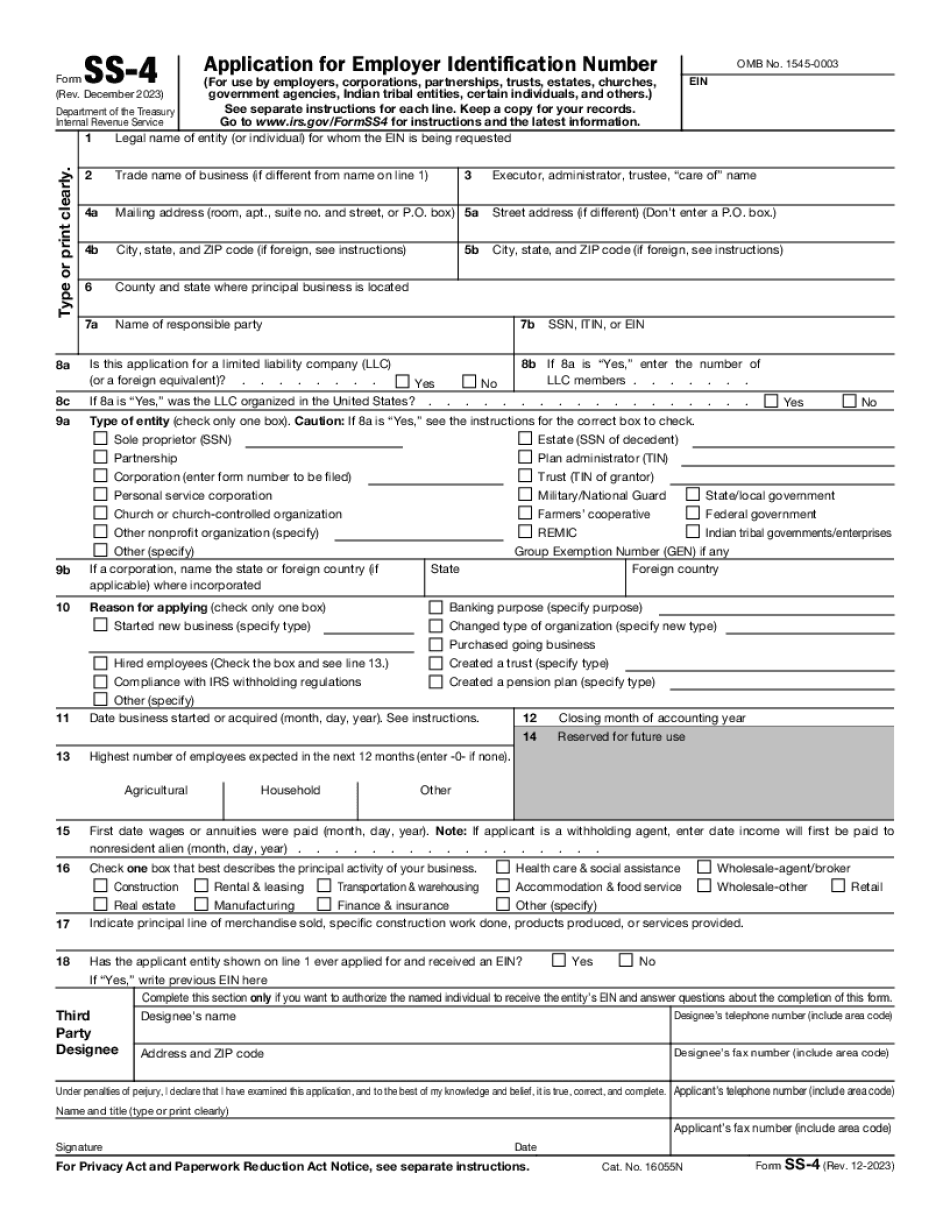

This regulation also establishes the procedure for a “business entity” to obtain an SS-4. Is My LLC a Business Entity That Obtains an SS-4? — Legalism April 1, 2025 — In March and April 2022, the Internal Revenue Service (IRS) issued Notice 2014-41R, which is a regulatory requirement on whether an organization is a “business” or “nonbusiness” entity. In addition, on April 17, 2020, IRS Notice 2014-48, the final regulation on the treatment of business entities, will be released. Notice 2014-48 is a final rule to clarify the interpretation of Business Exemption Code sections 501(c)(3) and 523 of the Internal Revenue Code (IRC), both of which specifically relate to business entities (non-profit organizations, partnerships, and sole proprietorship) and are in addition to IRS Notice 2014-41R. In other words, both of these new regulations can be found at the IRS website at, and is a major regulation that will affect any business entity. This post is about an existing business entity that is not a business, and obtaining a SS-4. If not a business entity, this post is for you as you are just interested in obtaining a SS-4 to start your own business. If your business owns or operates several vehicles, you will have to use multiple SS-4s, one for each vehicle, on each tax day. Below are the instructions to obtain an SS-4 for your business. How can I determine if a business is an entity? Business entity has a certain amount of ownership interest in another entity that is required to be filed separately. This means that each business entity that operates is a separate entity. If the business entity is owned by a corporation, the LLC (limited liability company) is the entity. The corporation will not be required to separate. The LLC is separate from the corporation. This is called business ownership. A person can be a business owner, while being an employee/contractor of a corporation. See my answer (below). May 2, 2025 — An entity, business, or other person (such as a corporation) that wishes to be considered a business must submit to the Internal Revenue Service (IRS) Form SS-4.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form SS-4 for Vacaville California, keep away from glitches and furnish it inside a timely method:

How to complete a Form SS-4 for Vacaville California?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form SS-4 for Vacaville California aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form SS-4 for Vacaville California from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.