Award-winning PDF software

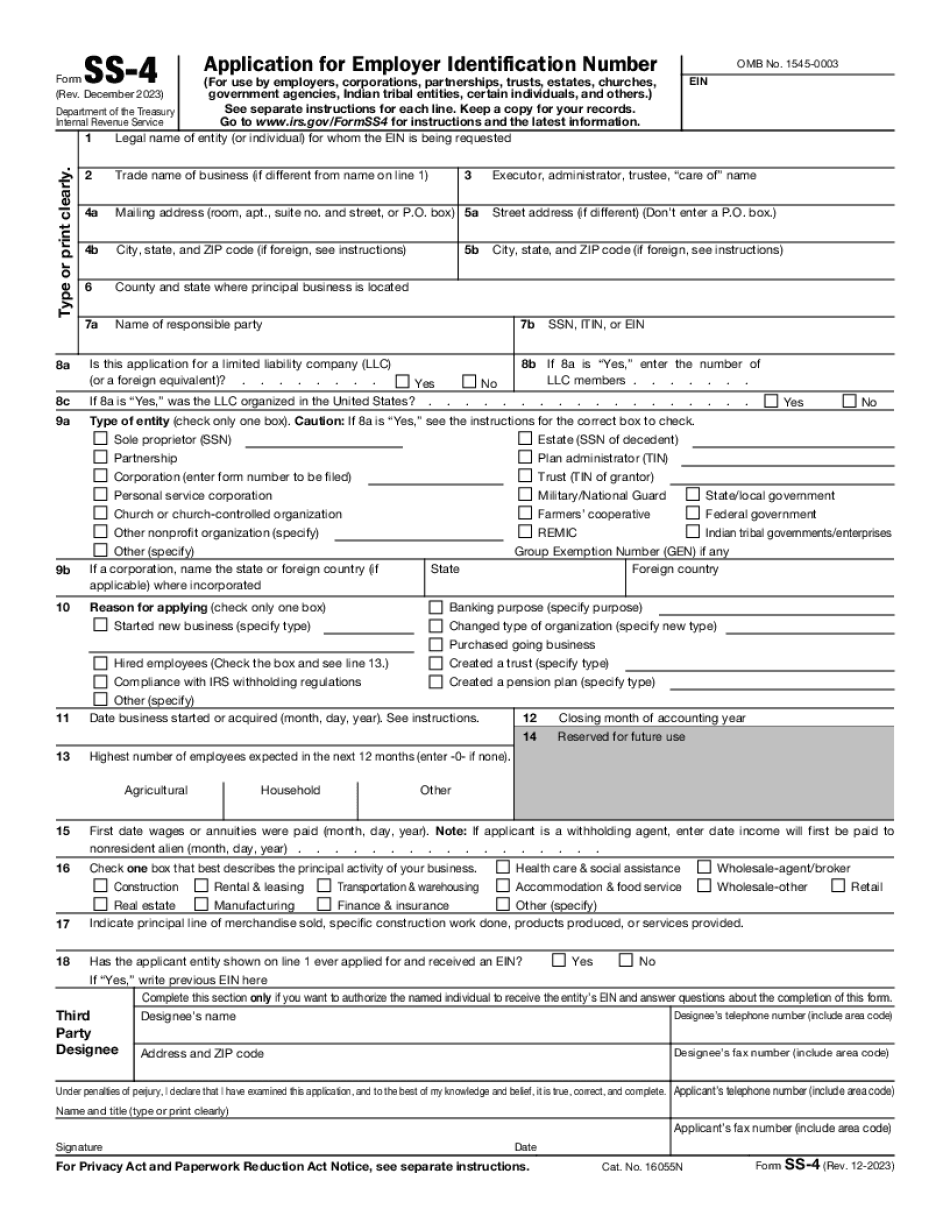

Form SS-4 for Thornton Colorado: What You Should Know

SLC, UT 84101 Note: If the applicant entity has an EIN it must have the EIN updated, if a company entity or partnership it must have the company's/partnership's EIN updated. Exempt Organizations —City of Colorado Springs A tax exemption notice from the Colorado Springs City Government is required when an organization applies to become a tax-exempt nonprofit organization. The IRS has created an Exempt Organizations Portal on the I.R.S. Website for application instructions and guidance. To access the portal, go to Taxpayer Portal for Exempt Organizations in Colorado Springs. A non-profit organization, other than a religious organization, may apply to become a tax-exempt charity under Internal Revenue Code section 501(c)(3), provided that: a) A substantial part of its activities are charitable; b) It has in effect a governing document which provides for the organization to be governed and operated in conformity with the requirements of Internal Revenue Code section 501(c)(3) (including the provisions concerning the organization's purpose and the period during which that purpose must be carried out); and c) It engages in a substantial amount of noncharitable fundraising activities. Charities must satisfy all the following conditions to qualify as a 501(c)(3): If your organization meets all of these conditions, it may apply for exempt status using one of these methods: 1. Allocate all contributions toward exempt purposes. Allocate the greatest of 30% of all gross receipts or 100% of all contributions over 200,000 to a charitable purpose. 2. Donated to another charity of which you are registered pursuant to section 170(c)(1)(D). Receive donations from your registered charity(s), your spouse, and your dependent children or ward(s). 3. Directly or through a licensed out-of-state distributor (see below for additional details). Direct you to the licensee responsible for processing the application for direct donation for your organization. 4. Pay the applicable license fee. Pay the applicable tax fee.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form SS-4 for Thornton Colorado, keep away from glitches and furnish it inside a timely method:

How to complete a Form SS-4 for Thornton Colorado?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form SS-4 for Thornton Colorado aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form SS-4 for Thornton Colorado from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.