Award-winning PDF software

Form SS-4 for Pittsburgh Pennsylvania: What You Should Know

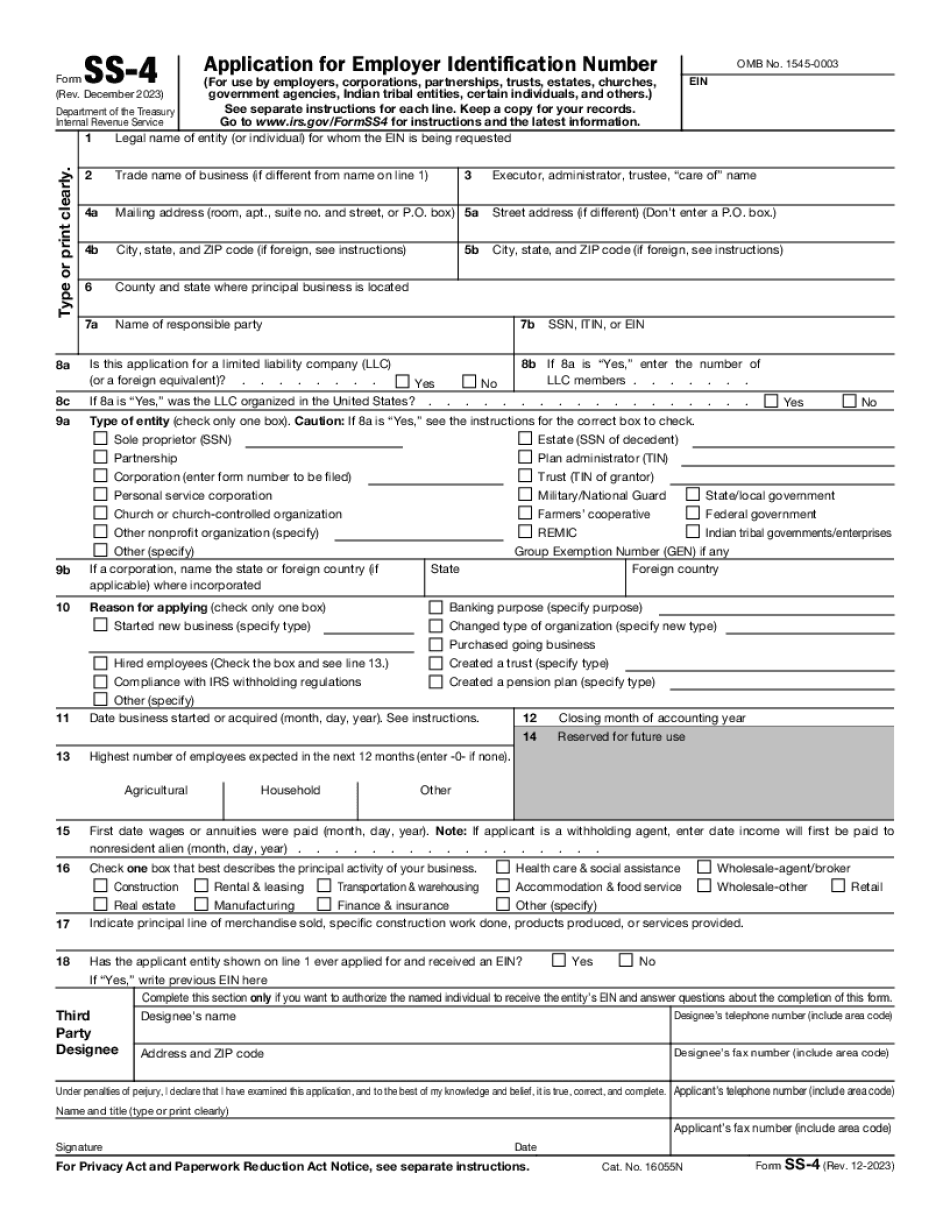

In the course of your activities as owner, do you meet the requirements for business organization? — No. — Yes. — An entity under the Taxation Code. This includes: corporations or any legal entity that has been created under the laws of Pennsylvania and that can legally conduct its business or affairs in the State. In the course of your activities as owner, do you meet certain requirements for taxation? This includes being in the process of reorganization or otherwise changing the organization to be a for-profit corporation, nonprofit association, labor union, or other organization that engages in commercial or professional activity. What information does this form ask? Your name and address is what you provide on the “Application for Employer Identification — IRS”. You do not supply this information through the questionnaire or forms. You answer yes to questions regarding the following: The owner or operator of the organization is an individual, corporation, or other entity that conducts business within the City of Pittsburgh. Name and address of the owner, operator, or general partner of the owner or operator's business. The total annual gross receipts of the operation including the annual gross receipts of the operating division, and what kind of business activities is carried on by the organization. Total receipts and expenses over the prior 3-year period. Employment income received from such operations. The tax will not be due until these items have been collected, and your tax return filed with a tax return preparation fee of 5.00 Why does the IRS require an EIN? The IRS is required to have your EIN when it begins conducting its audit of your individual returns. This requires the organization to have a valid EIN to process tax returns and collect the taxes owed on them. This enables the IRS to identify your business entity. Who should file this form? Individuals who have no physical presence within the City of Pittsburgh must still file a paper copy if they wish to have an EIN issued. This should only be needed for situations where they are conducting business to include, but not limited to, employment. You should not rely solely on this form to obtain an EIN though. You may obtain an EIN from the Secretary of State, or the IRS, depending on your location. Business organizations that will do business within the City of Pittsburgh.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form SS-4 for Pittsburgh Pennsylvania, keep away from glitches and furnish it inside a timely method:

How to complete a Form SS-4 for Pittsburgh Pennsylvania?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form SS-4 for Pittsburgh Pennsylvania aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form SS-4 for Pittsburgh Pennsylvania from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.