Award-winning PDF software

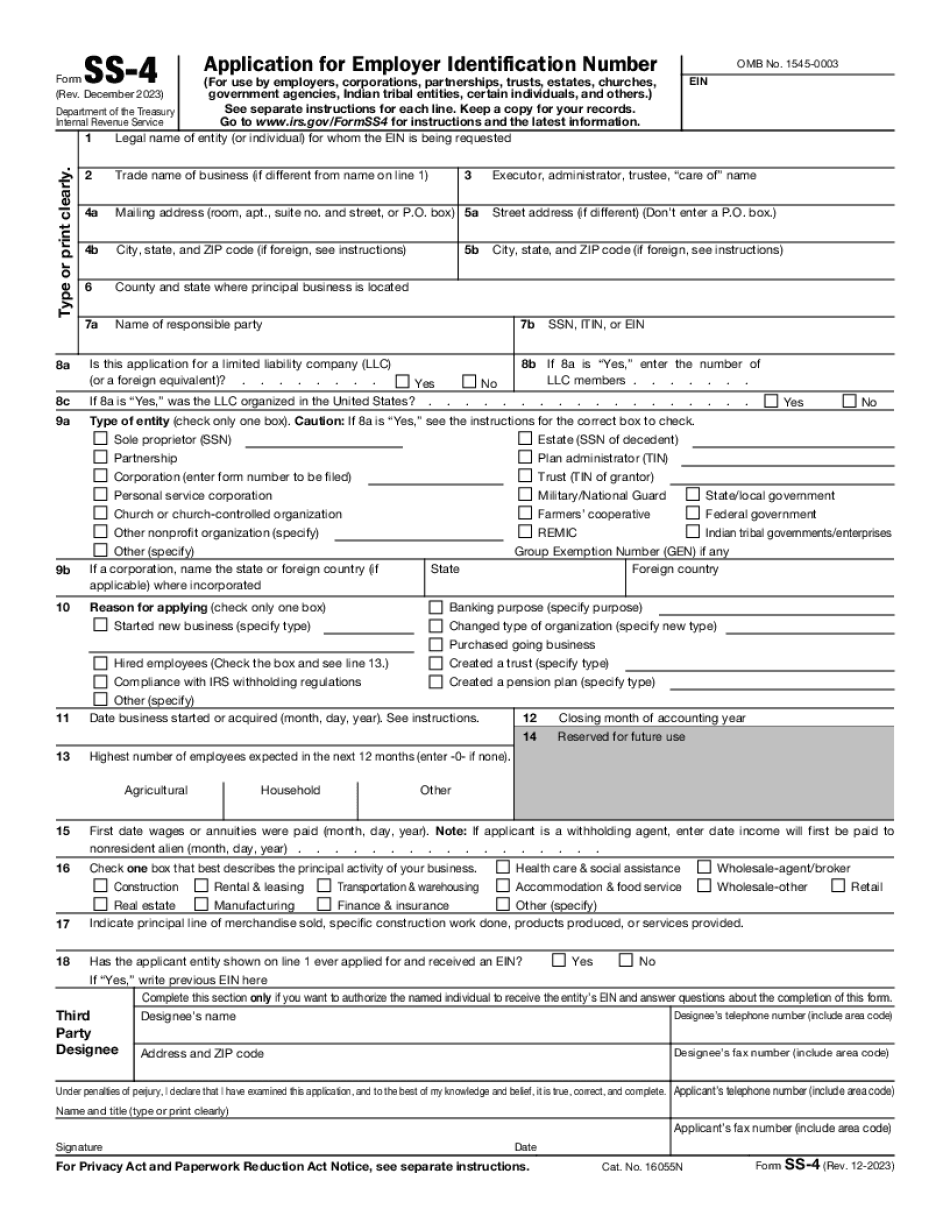

Form SS-4 for Palmdale California: What You Should Know

Opponents' and supporters' arguments Opponents' argument against the ballot measure Prop 64 — Supporters' argument in favor of Prop 64 — How to Prepare A Comment Read my guide about the “Fiscal Fairness for Small Business” referendum, the proposed state ballot measure that would amend the California constitution to require statewide, tax-exempt, government-backed loans to businesses. How Prop. 64 Would Affect Your Business If Proposition 64 passes, you may lose your eligibility to get government loans. It is possible that one federal loan program may cease to exist if Prop. 64 passes and another program may have to change. A company may find it hard to get additional funds, especially if the company was able to come up with 5 Million to get its loan program funded. Prop 64 also changes the criteria for a tax credit. You will have to pay a higher percentage of federal income tax and state income tax over your actual business profits. The percentage will increase over the life of the loan for the first 5 years, and it will decrease for the remainder of the loan term. To get a loan without facing possible loss of business or income tax, you may also have to give up some flexibility on how you do business. You will have to pay back a certain percentage of your loans on a quarterly basis. If the company fails to have the tax dollars coming in for a tax year, it may have to pay back an additional amount from its income tax funds. All loans are capped at 450,000 per project in an industry with a 100 million or more market capitalization. As well, any loans under 450,000 will be repaid with a refund. If the loan amount is greater than 450,000, you may have the money back only after you meet certain performance goals. For a detailed look at Prop. 64's new rules, read my blog, “Why Prop. 64 Will Affect Your Business” What the Prop. 64 Commission Recommendation Means The Prop. 64 commission did not recommend passing the amendment because the commission believed it would hurt many small businesses and could drive up taxes or fees for taxpayers. The recommendation said the proposal would have unintended consequences, but it did not give specifics. It also did not address the possibility that the proposed ballot measure could impact local government taxes if the proposition is approved and a new local income tax is established. The Prop. 64 Commission's recommendations are an estimate for future effects.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form SS-4 for Palmdale California, keep away from glitches and furnish it inside a timely method:

How to complete a Form SS-4 for Palmdale California?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form SS-4 for Palmdale California aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form SS-4 for Palmdale California from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.