Award-winning PDF software

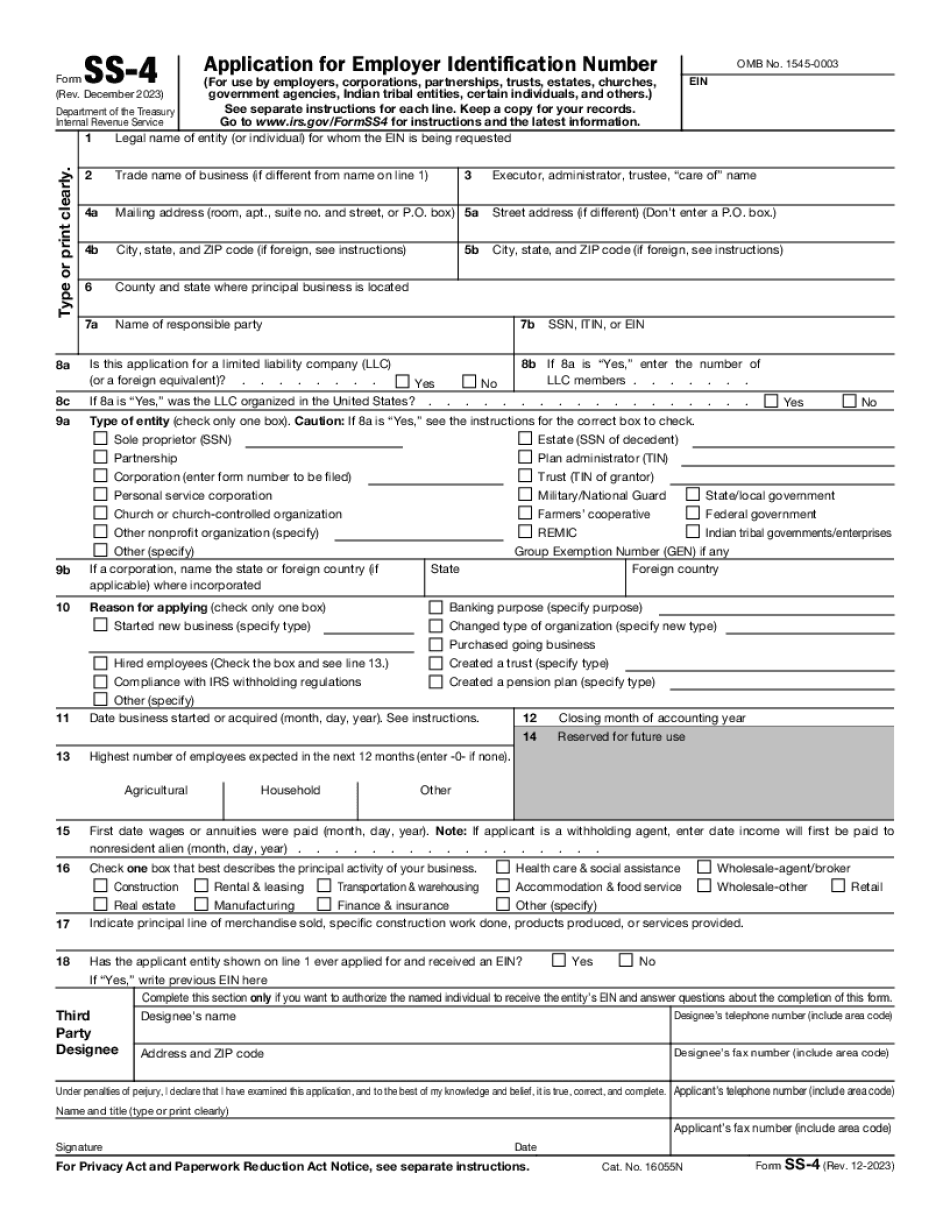

Form SS-4 for Gilbert Arizona: What You Should Know

Form SS-4 only becomes effective December 1, 2018,, but we have to take it online so your e-filing deadline is January 31, 2019. See IRS Instructions: The Individual and Corporate Taxpayer (Form SS-4) for the Arizona Corporation Tax on Form SS-4. [PDF, 3.14 MB, 34 pages] A company with LLC Tax status using an electronic company submission will be able to upload their tax software and then electronically provide the SS-4 electronically. [PDF, 1.38 MB] The Form SS-4 will not be automatically submitted to the IRS by your e-file system. It must be completed and submitted at least 3 business days in advance of e-filing. To ensure you have enough time to complete the SS-4, please contact the agency to ensure they have received your paper request for the SS-4 before submitting your SS-4. [PDF, 1.5 MB, 16 pages] The Form SS-4 does not have to be signed in order for the Arizona Corporation Tax to be paid. The Arizona LLC Tax will be paid on the LLC Return; The Arizona LLC Tax Return must be filed first; Do not file an Arizona LLC Tax Return until your SS-4 is received and verified. However, if you have filed your Arizona LLC Tax Return, we can still submit the Form SS-4 for you in lieu of you signing it in. See the How to Find A Business In Arizona document for more information if you use the online business tool provided in the online Business Services and Guide to Companies booklet. Get an Arizona LLC, Notary Public, or Notary Agent License Here — Tax. 18 January 2018. The Arizona Court of Appeals issued the following order today: A. The Arizona Supreme Court will not hear oral arguments on the April 25 Supreme Court of Arizona case concerning the Arizona statutes and rules, as applied to the requirements of the Arizona Business License Amendment Act (AB 1813). The decision (PDF) is (click on the citation), and also available on the Arizona website here, (click here). B. The Arizona Legislature will be taking up legislation concerning a revised business license scheme. Legislative analysis regarding the revised business license scheme (PDF) is also available. Get a Business Account Update Form (ARDOR 10193); to add a Gilbert location to your existing ARDOR License. Important Notice. Important! A.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form SS-4 for Gilbert Arizona, keep away from glitches and furnish it inside a timely method:

How to complete a Form SS-4 for Gilbert Arizona?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form SS-4 for Gilbert Arizona aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form SS-4 for Gilbert Arizona from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.