Award-winning PDF software

Form SS-4 College Station Texas: What You Should Know

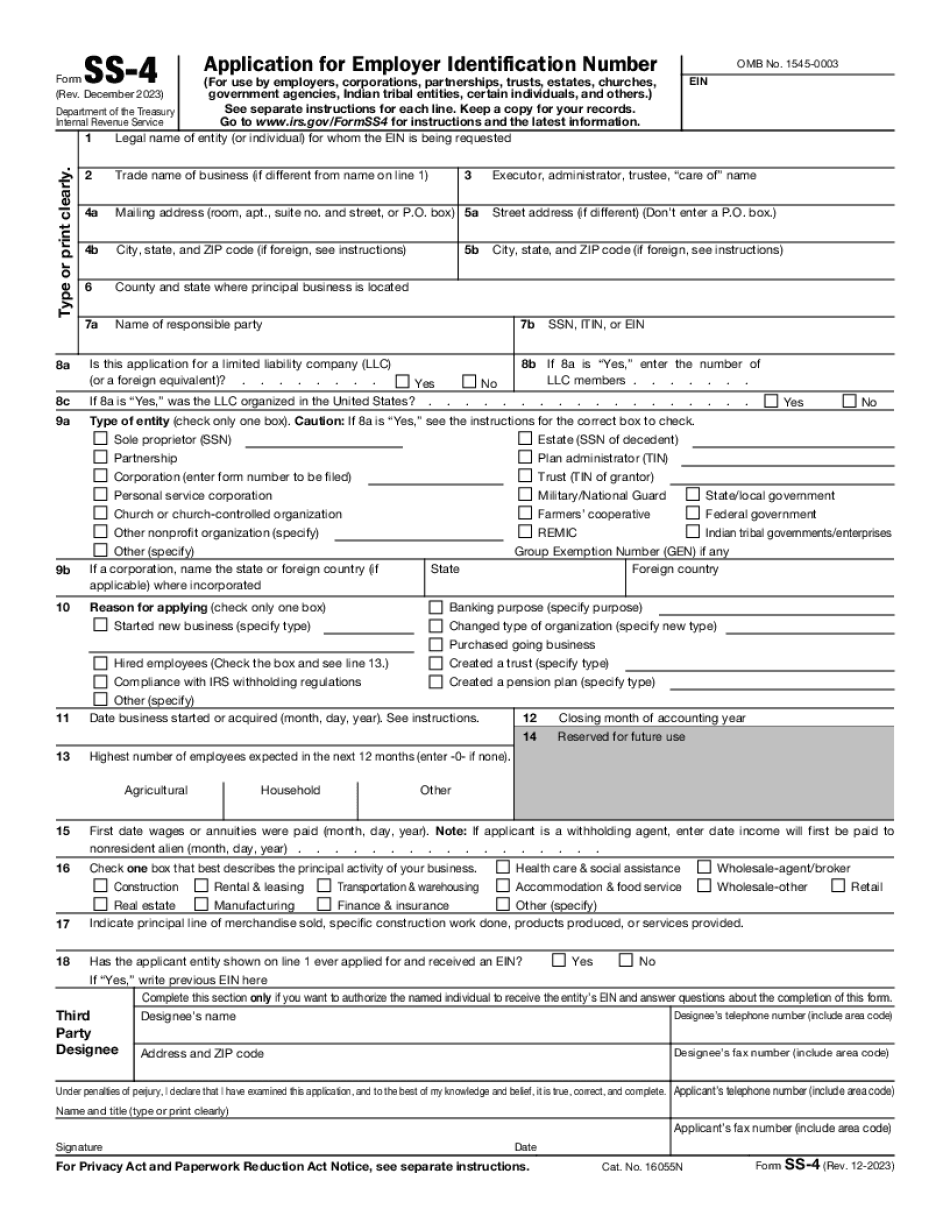

Read H&R Block's SS-4 Tax Info. SS-4 Tax Form: What You Need to Know — H&R Block What is SS-4 Tax Form, What Is the EIN Need? The form you are filing for your personal SS-4, or EIN. If your family receives wages and is also a sole proprietor, partnership, or corporation you will need to select either (1) Form SS-4-B (Individual) or (2) Form SS-4-A (Business entity) on your federal tax return. To figure what your SS-4 tax form will look like, see which form you will be filing, and decide which one you will use to apply for EIN status. For more information on the SS-4, which is used to apply for EIN status, refer to this article, which has more information on the SS-4. Also check out Form SS-4. It provides some great insight into the important benefits of having an SS-4 tax form, including the information you need to complete the form and how much additional work you will need to get started. Getting an Employer Identification Number (EIN) can be confusing because all too often business owners are confused when they try to obtain an EIN and then discover that they don't understand what is required. So, below I will present to you a simple overview on what the EIN is, what your employer must submit when applying for an EIN, and then a step-by-step guide on how to get started. If you need additional assistance with this, call the Internal Revenue Service at to speak with a tax professional. Read How to Get an Employer Identification Number : IRS or contact the H&R Block Account Representative at x1034. To get Start Date for Your Business. Read What is Start Date. Form SS-4, Application for Employer Identification Number — IRS How to Complete and File Form SS-4. (Rev. December 2019). Who must File an Application for Employer Identification Number? It is the employer's responsibility to file an application and get the proper ID information from their payroll department by the applicable deadline.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form SS-4 College Station Texas, keep away from glitches and furnish it inside a timely method:

How to complete a Form SS-4 College Station Texas?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form SS-4 College Station Texas aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form SS-4 College Station Texas from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.