Should use an EIN or an SSN for opening up a business bank account? That's the subject of today's question. I don't really have a name for the show, but hey yeah, my name is Jim Hart. I'm the founding attorney here at Hawthorn law. I have to apologize because we have not been producing content regularly enough for you. One of the main reasons for that is at the beginning of November, we were notified that our lease was going to be cancelled by our landlord. This happened to everyone in our building, not just us. They couldn't renegotiate their lease with the owner of the building, so they had to cancel everyone's lease. We've all been scrambling to find new office space. I'm actually right now in the process of moving into a new office condo down the road. It's a much bigger space and it's gonna be a great space. I'm excited because it'll give me an opportunity to expand and do some other things. But that's what's happening, and that's why I haven't been posting videos as regularly as I typically would. Anyway, this question comes to us from Emmie Cami Won. It says, if you have a single member LLC taxed as a disregarded entity, and you want to open a business bank account, should you use the EIN issued for the LLC or your personal social security number? When you're opening up your business bank account for the first time, do you use a social security number or an EIN? Now, it really depends on the type of business entity you're going to be using for your business. If you're simply a sole proprietor and you want to open up a new bank account for your business, you can open up a business bank...

Award-winning PDF software

Are federal Ein Numbers public record Form: What You Should Know

Use The Company Name To Find You can look up your company name, using the name of your parent company or company you work for. But, you can use more than one business name to find your former employer. A Note About The Company Name: This is the same as your business. So, what is wrong with using “Wins” to see if you worked for that company? You use the company name, name of your business, and you can do it on your own too. Just don't use it if you plan to use it legally.

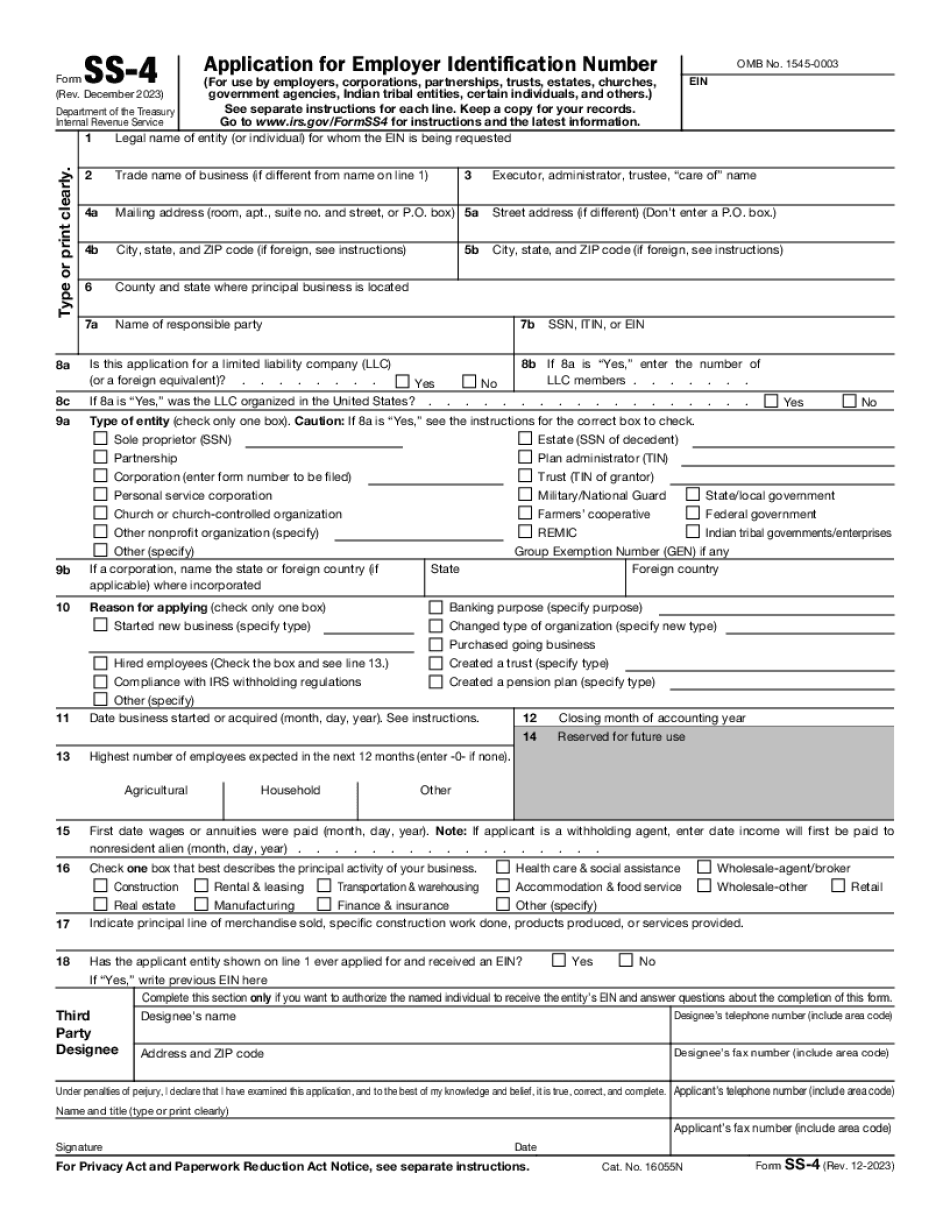

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form SS-4, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form SS-4 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form SS-4 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form SS-4 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Are federal Ein Numbers public record