Welcome to realsearch.com, the nation's leader in investigative databases. We feature billions of records, including police-level background checks and criminal records. We offer comprehensive email and cell phone databases, and you can fly now for a free test drive. Businesses and professionals can also take advantage of our free trial, which includes access to cell phone data, criminal history with mugshots, and arrest records. For private investigators and business professionals, we offer a 5-day free trial. Simply apply at realsearch.com, it's easy to register. Come sign up and experience the largest EIN database in the United States. We also have a number of other interesting files, serving over 260,000 business users. Our platform allows you to skip-trace and reconnect with old friends. Everything is connectable through XML and API. Give us a call at 800-299-8280 or visit realsearch.com. If you're a licensed professional or an investigator, don't forget to upload your compliance credentials once you login. Go to my profile and upload your documents, and it will guide you through the process. We're excited to have you at realsearch.com. Remember, professionals can enjoy a 5-day free trial. Our pricing ranges from $20 to $99 a month, and we're powered by Liberty Data. Click on realsearch.com to register and try your 5-day free trial. We look forward to connecting with you.

Award-winning PDF software

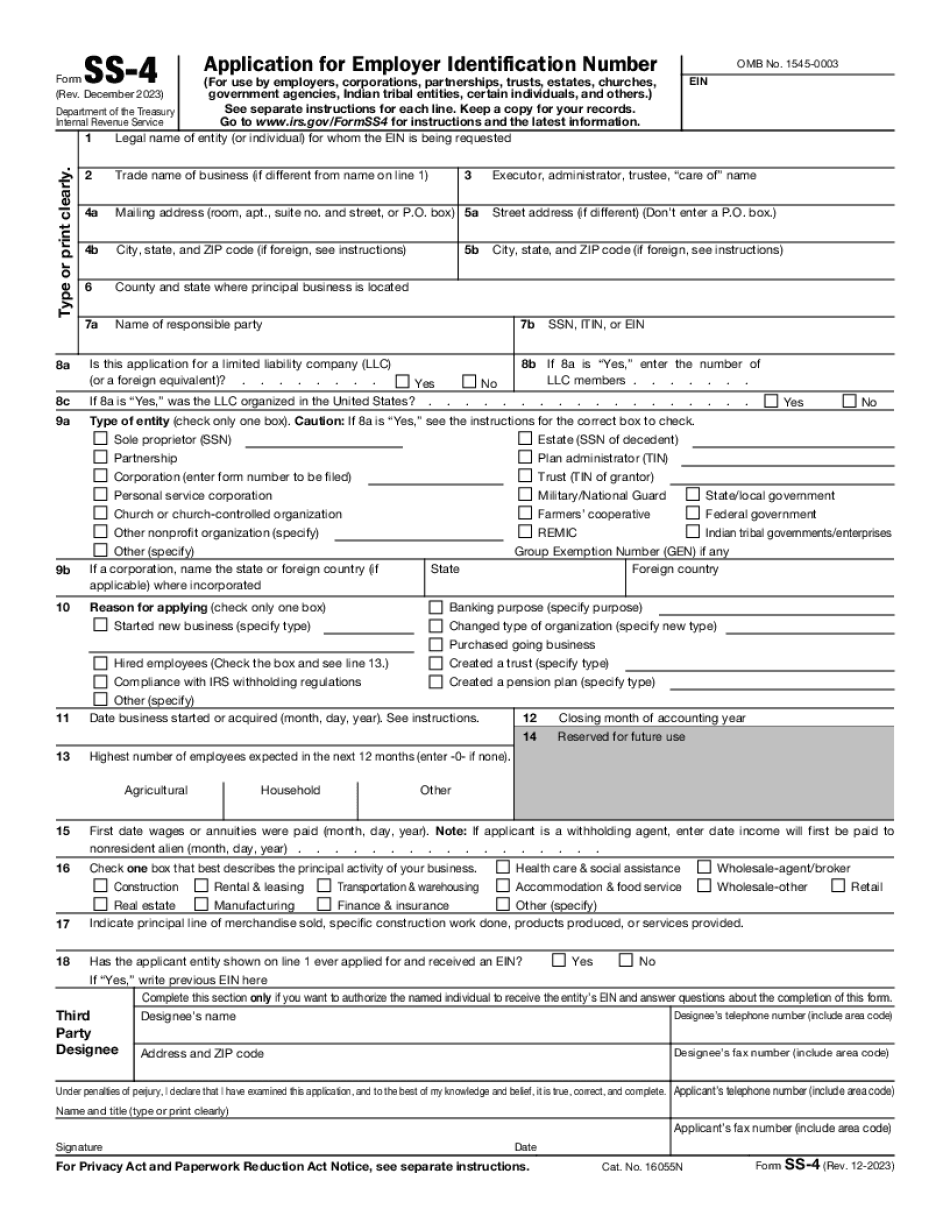

Reverse Ein lookup Form: What You Should Know

EIN Lookup: How to Get a Business Tax Number — Personal Finance.com Sep 1, 2025 — You can request a reverse EIN by faxing or emailing your EIN to the Federal Tax Bureau's Taxpayer Assistance Division at. How To Get a Business EIN (or a Tax Identification Number) — MoneySavingExpert.com Aug 29, 2025 — You can get a reverse EIN to get back to business by providing your employer identification number (EIN). Get a Business EIN — MoneySavingExpert.com Sep 1, 2025 — Your EIN number consists of 3 numbers that you must record with a letter, digit, and letter and digit. The first two numbers are your business' Taxpayer Identification Number, while the fourth is a random combination of numbers. This will allow you to identify who owns and controls your company. You should not use this information in any other way. Who Needs To Have an IRS Business EIN? — Federal Tax Institute Here's how to complete an EIN lookup, so you can get back to business. Take the IRS Form SS-4 and fill it out completely. Form SS-4: Who Needs an IRS EIN? — Federal Tax Institute Mar 1, 2025 — If you do not have an EIN, you'll need to fill out the IRS form SS-4 (Application to Obtain an IRS Business EIN) and send it back. Form SS-4: Who Needs an IRS EIN? — Federal Tax Institute Apr 1, 2025 — You will need to mail in the form for your EIN. The postal carrier may charge a couple of dollars per envelope or something. If you want an IRS Business EIN, go ahead and wait. It will be processed shortly. Should You Get an IRS EIN? — Fidelity.com If you have a legitimate reason, you may qualify for an IRS EIN, so that your company or business will no longer have to produce a Tax Identification Number (TIN) for business tax purposes. What Is a Business EIN? — Fidelity.com Mar 1, 2025 — Businesses are considered “enterprises” for Internal Revenue Service (IRS) tax purposes and must have a Taxpayer Identification Number (TIN) to meet the filing requirements for the Individual Taxpayer Identification Number (ITIN) that taxpayers are required to provide.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form SS-4, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form SS-4 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form SS-4 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form SS-4 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Reverse Ein lookup